In Hand Salary Calculator New York

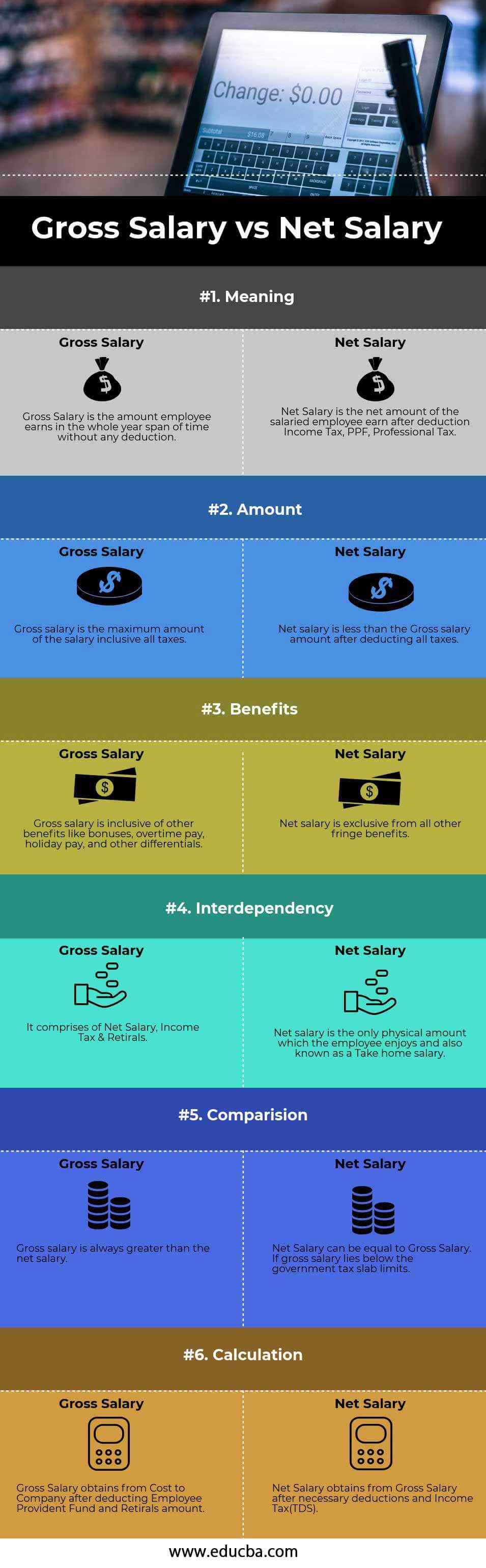

If you make 55000 a year living in the region of New York USA you will be taxed 12213. It refers to the salary that an employee takes home once after the deduction of employment taxes cost of benefits and other retirement contributions.

Paycheck Calculator Take Home Pay Calculator

For instance an increase of 100 in your salary will be taxed 3491 hence your net pay will only increase by 6509.

In hand salary calculator new york. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. After this you will pay 20 on any of your earnings between 12571 and 50270 and 40 on your income between 50271 and 150000. What salary does a Hand earn in New York City.

Annual Salary Bi-Weekly Gross 14 days X 365 days. After a few seconds you will be provided with a full breakdown of the tax you are paying. Your average tax rate is 221 and your marginal tax rate is 349.

This number is the gross pay per pay period. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculating Annual Salary Using Bi-Weekly Gross.

For only 50 USD you will know the salary you need in New York City to maintain your current standard of living after you move. Meanwhile the highest tax bracket reaches 1075 on income over 5 million. 35 Hand Salaries in New York City NY provided anonymously by employees.

Your average tax rate is 222 and your marginal tax rate is 361. If your bi-weekly gross is 191781 your Annual Salary 191781 14 days X 365 days 50000. Given that the first tax bracket is 10 you will pay 10 tax.

Calculate your New York net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New York paycheck calculator. The average salary for a Hand is 63683 in New York City NY. 365 days in the year please use 366 for leap years Formula.

On the other hand there are eight tax brackets for married people who file jointly and heads of household. That means that your net pay will be 42787 per year or 3566 per month. Simply enter your annual or monthly gross salary to get a breakdown of your taxes and your take-home pay.

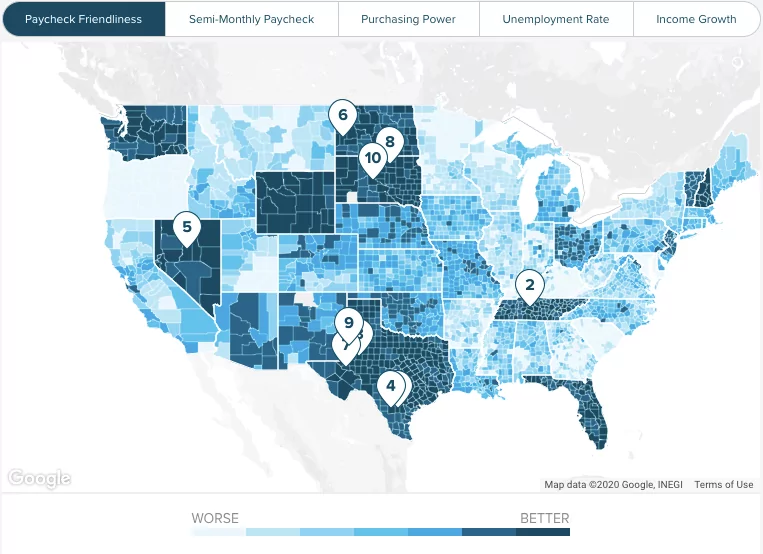

Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 882 depending on taxpayers income level and filing status. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Details of the personal income tax rates used in the 2021 New York State Calculator are published below the.

Dont want to calculate this by hand. It should not be relied upon to calculate exact taxes payroll or other financial data. Use In Hand salary calculator to find your Take Home Salary from the total CTC.

How much does a Hand make in New York City NY. This is known as your personal allowance which works out to 12570 for the 20212022 tax year. Calculating Hourly Rate Using Annual Salary.

14 days in a bi-weekly pay period. The New York Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2021 and New York State Income Tax Rates and Thresholds in 2021. This independent calculation will help you justify your salary demands in your.

Use the salary calculator above to quickly find out how much tax you will need to pay on your income. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. How to calculate taxes taken out of a paycheck.

Anything you earn above 150000 is taxed at 45. Take home pay is also referred as Net salary. You will get a 14-page downloadable report calculating the salary youll need.

Subtract any deductions and payroll taxes from the gross pay to get net pay. The PaycheckCity salary calculator will do the calculating for you. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Calculate the salary that you will need in New York City based on the cost of living difference with your current city. Salaries estimates are based on 12450 salaries submitted anonymously to Glassdoor by Hand employees in New York City NY. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Starting with your salary of 40000 your standard deduction of 12550 is deducted the personal exemption of 4050 is eliminated for 20182025. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New York.

To use our New York Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Important Note on CalculatorThe calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. This makes your total taxable income amount 27450.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. At the lower end you will pay at a rate of 140 on the first 20000 of your taxable income.

The Calculator Helps You Identify Your Tax Withholding To Make Sure You Have The Right Amount Of Tax Withheld From Your Payche Irs Taxes Tax Budgeting Finances

How Much In Hand Can I Expect If Getting 12 Lpa As Fixed Salary Quora

How To Calculate Travel Nursing Net Pay Bluepipes Blog Travel Nursing Travel Nursing Pay Nurse

Comparison Of Uk And Usa Take Home The Salary Calculator

How To Calculate The Net Salary From Gross In Portugal Lisbob Salary Portugal Calculator

Mm Obraz A Rade Gross Salary Net Salary Calculator Usa Justan Net

I Ve Eaten On 2 A Day And Tried Living On An 8 15 An Hour Salary In New York City Here Are My 10 Best Tips To Save Money Bank Of America Bank

New York Paycheck Calculator Smartasset

Israel Salary Calculator 2021 22

In Hand Salary Calculator 2021 Pay Slips Monthly Tax India

Us Tax Calculator 2021 Us Salary Calculator 2021 Icalcul

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

How Much Does A Nanny Cost Nanny Salary Index 20 21 Nannytax

You Vs Kardashians In 2021 Salary Calculator Kardashian Salary

Paycheck Calculator Take Home Pay Calculator

In Hand Salary Calculator 2021 Pay Slips Monthly Tax India

Post a Comment for "In Hand Salary Calculator New York"