Gross Income Calculator Washington

How Income Taxes Are Calculated. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Washington paycheck calculator.

Gross income calculator washington. Use this Washington gross pay calculator to gross up wages based on net pay. Apple Health for Families and Caretaker Relatives. Apple Health Medical Extension for Families and Caretaker Relatives.

There are two ways to determine your yearly net income. Free online gross pay salary calculator plus calculators for exponents math fractions factoring plane geometry solid geometry algebra finance and more. The results are broken up into three sections.

Washington DC Gross-Up Calculator. Calculate your Washington DC net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Washington DC paycheck calculator. To use our Washington Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

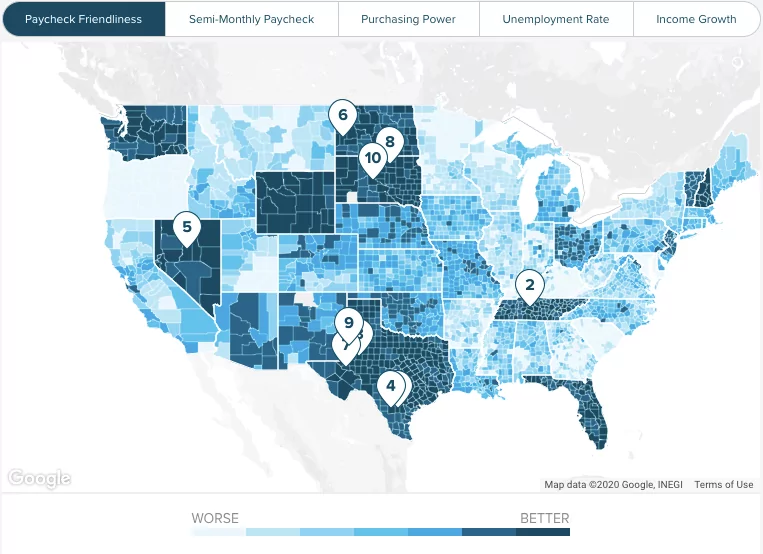

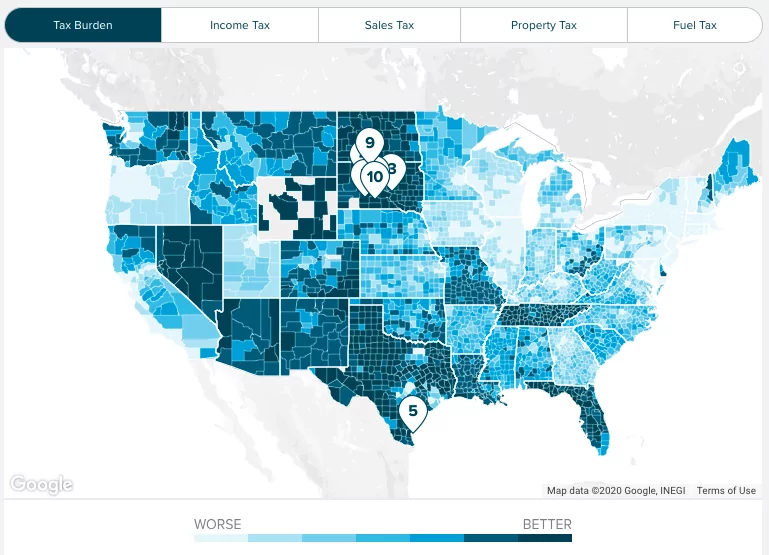

How much you pay in federal income taxes depends on a few different factors like your marital status salary and if you want any additional withholdings. While taxpayers in Washington dodge income taxes they pay some of the highest sales taxes in the country with a combined state and average local rate of 923. For purposes of determining eligibility for modified adjusted gross income MAGIbased Washington apple health WAH see WAC 182-509-0300 income is considered available to a person if.

However federal income and FICA Federal Insurance Contribution Act taxes are unavoidable no matter where you work. Apple Health for Kids with and without premiums. You can use our Monthly Gross Income calculator to determine your gross income based on how frequently you are paid and the amount of income you make per pay period.

After a few seconds you will be provided with a full breakdown of the tax you are paying. On this page is a 2020 income percentile by state calculator for the United States. First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k.

If you make 55000 a year living in the region of Washington USA you will be taxed 9434That means that your net pay will be 45566 per year or 3797 per month. Some money from your salary goes to a pension savings account insurance and other taxes. Summary report for total hours and total pay.

Washington Salary Paycheck Calculator. WAC 182-509-0315 MAGI income -- Ownership of income. Select how often you are paid and input how much money you earn per pay period and the calculator shows you your monthly gross income.

Below are your Washington salary paycheck results. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Effective January 9 2014.

Net income is the money after taxation. Use this Washington DC gross pay calculator to gross up wages based on net pay. An individual in the persons medical assistance unit receives or can reasonably predict that he or she will receive the income.

Has relatively high income tax rates on a nationwide scale. It determines the amount of gross wages before taxes and. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

Capital has a progressive income tax. If you are paid hourly multiply your hourly. Calculate the gross amount of pay based on hours worked and rate of pay including overtime.

It determines the amount of gross wages before taxes and deductions. Enter pre-tax income earned between January and December 2019 and select a state and income type to compare an income percentile. Your average tax rate is 172 and your marginal tax rate is 299This marginal tax rate means that your immediate additional income will be taxed at this rate.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. Washington state does not impose a state income tax. It works for either individual income or household income or alternatively only to compare salary wage income.

Salary Tax Calculations for a Washington Resident Earning 8500000 Print version While the United States has its own set of general tax rules that all states. Also we separately calculate the federal income taxes you will owe in the 2019 - 2020 filing season based on the Trump Tax Plan. Annual net income calculator.

Enter either your gross hourly wage into the first field or your gross annual income into the fourth field. Set the net hourly rate in the net salary section. Your results have expired.

Overview of District of Columbia Taxes. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Washington.

You can also choose comparison states and show the income. Apple Health for Pregnant Women. Washington is one of several states without a personal income tax but that doesnt mean that the Evergreen State is a tax haven.

Washington And The Aca S Medicaid Expansion Healthinsurance Org

Washington Paycheck Calculator Smartasset

Washington Salary Paycheck Calculator Paycheckcity

Washington Paycheck Calculator Smartasset

Hrpaych Yeartodate Payroll Services Washington State University

Gross Pay And Net Pay What S The Difference Paycheckcity

Washington Paycheck Calculator Smartasset

New Tax Law Take Home Pay Calculator For 75 000 Salary

Washington Income Tax Calculator Smartasset

Washington Income Tax Calculator Smartasset

Esdwagov Calculate Your Benefit

Pin On Wa State Financial Aid For Your Future

Your Discretionary Income Student Loans How One Impacts The Other Student Loan Hero

Gross Pay And Net Pay What S The Difference Paycheckcity

New Tax Law Take Home Pay Calculator For 75 000 Salary

Paycheck Calculator Take Home Pay Calculator

How Much Would You Receive From Disability Benefits Washington Post

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Post a Comment for "Gross Income Calculator Washington"