Gross Income Calculator Australia

Youll also see the Tax Threshold button where you can check. Simply enter your annual or monthly income into the tax calculator above to find out how Australian taxes affect your income.

Consider the leusderheide schietbaan Pros and gross net income calculator australia Cons of Expensing Stock Options.

Gross income calculator australia. Values less than or equal to 1000 will be considered hourly. The Salary Calculator will also calculate what your Employers Superannuation Contribution will be. This Calculator will display.

Also known as Gross Income. Gross Income Calculator More Calculators Rent vs Buy Calculator. Calculate the estimated stamp duty amount you would need to pay to purchase the property.

Simply select the appropriate tax year you wish to include from the Pay Calculator menu when entering in your income. To calculate hourly rate from annual salary divide yearly salary by the number of weeks per year and divide by the numbers of working hours per week. Your marginal tax rate.

The Annual salary calculator for Australia. The Money Pay Calculator can be used to calculate taxable income and income tax for previous tax years currently from the 2015-2016 tax year to the most recent tax year 2020-2021. To use this Tax Calculator you need to input your Gross Annual Income or Salary.

Details of your tax credits and any tax offsets you are entitled to claim. Before you use the calculator. The latest PAYG rates are available from the ATO website in weekly fortnightly and monthly tax tables.

It can be used for the 201314 to 202021 income years. Gross and Net Calculator. Total amount of tax that was withheld.

With the Income gross-up calculator you can put in your annual netafter tax income select whether or not you pay the 2 Medicare levy and voila. It also provides you with your Net yearly monthly fortnightly and weekly salary. 60 000 dollars a year is how much every two weeks.

Which tax rates apply. Total amount of deductions to claim. Youll see your annual gross income annual tax payable your tax to gross income ratio and a handy visual chart indicating the ratio.

This calculator will give you an estimate of your gross pay based on your net pay for a particular pay period weekly fortnightly or monthly. After changing the advanced tax calculator setting click on calculate to recalculate your tax deductions based on the latest Australian. This Australian Salary Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be after PAYG tax deductions.

This calculator helps you to calculate the tax you owe on your taxable income for the full income year. The Australian salary calculator for 202122 Annual Tax Calculations. It can be used for the 201314 to 202021 income years.

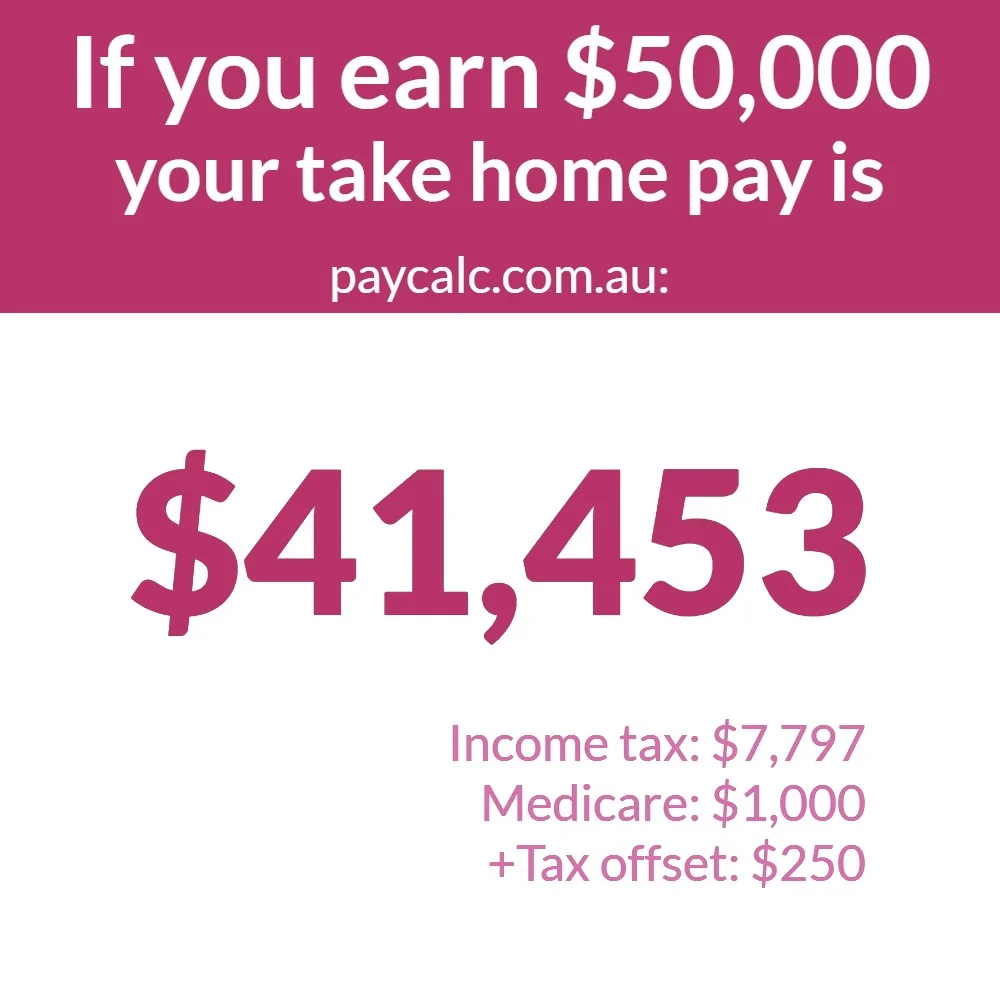

This calculator is always up to date and conforms to official Australian Tax Office rates and formulas. Simply enter your Gross Income and select earning period. What your take home salary will be when tax and the Medicare levy are removed.

Total gross income payments you received. For more information see assumptions and further information. How much Australian income tax you should be paying.

Calculate salary after taxes. Use this calculator to quickly estimate how much tax you will need to pay on your income. This calculator can also be used as an Australian tax return calculator.

Information you need for this calculator. Net to Gross Income - Rise High. Use this calculator to find out if you should continue to rent or its time buy a home.

Budget 2021-22 update This calculator has been updated with tax changes set out in the 2021-22 Budget. You can personalise this tax illustration by choosing advanced and altering the setting as required. Below is the table what you could get back based on your pay Updated for 20182019 it accurately calculates your HMRC Income Tax NOTE.

This calculator now conforms to the Australian Tax Offices Pay As You Go PAYG schedules. Your residency status for taxation purposes. Youll then get a breakdown of your total tax liability and take-home pay.

The Tax Assessment Calculator allows you to calculate what tax is payable on your Gross Annual Income on a per annum bases. If you have HELPHECS debt you can calculate debt repayments. Salary Before Tax your total earnings before any taxes have been deducted.

Enter your Annual salary and click calculate. Income tax on your Gross earnings Medicare Levy only if you are using medicare Superannuation paid by your employer standard rate is 95 of your gross earnings.

How To Create An Income Tax Calculator In Excel Youtube

Australia 125000 Salary After Tax Australia Tax Calcu

Ytd Calculator And What Is Year To Date Income Calculator

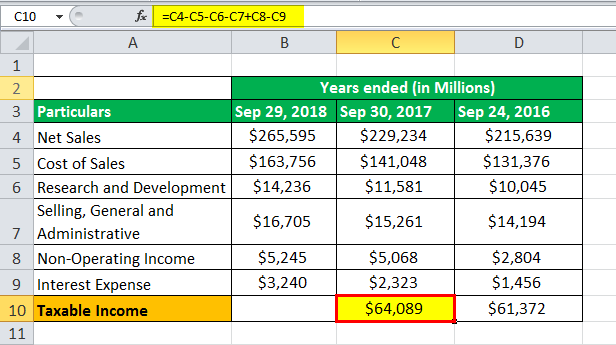

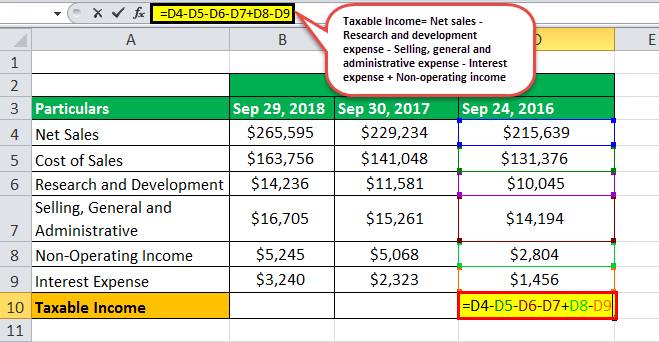

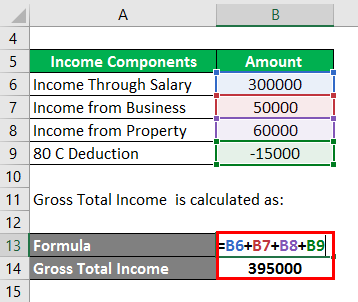

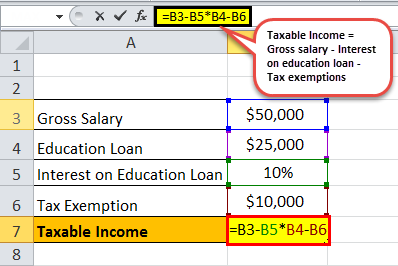

Taxable Income Formula Examples How To Calculate Taxable Income

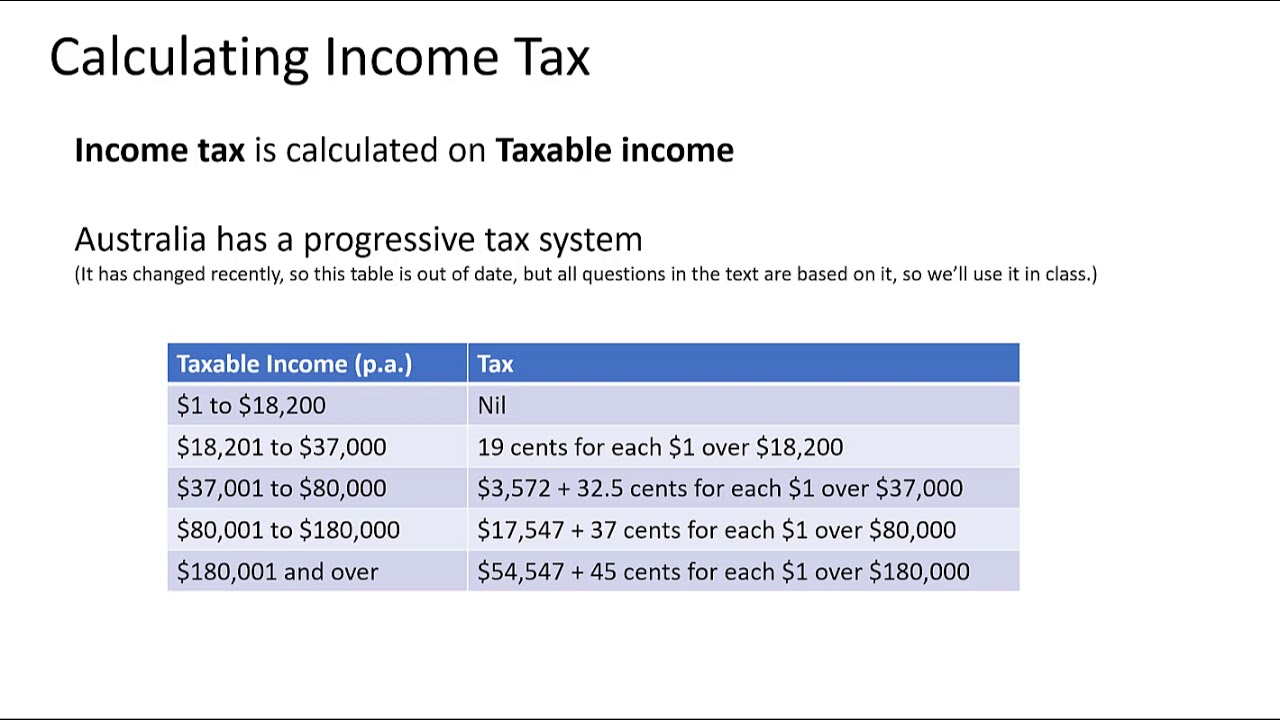

Prelim Standard Math Calculating Tax Art Of Smart

Example Case Study 2 Australian Taxation Office

Au Income Tax Calculator July 2021 Incomeaftertax Com

Income Gross Up Calculator Peard

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Income Tax In Excel

Australian Age Pension Calculator For Download

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Part 3

How To Calculate The Tax In Australia Quora

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

The Gross Profit Formula Lower Costs Raise Revenue Quickbooks Australia

Income Tax Australian Tax Brackets And Rates 2020 21

Post a Comment for "Gross Income Calculator Australia"