Gross Income To Net Income Calculator Canada

Line 25300 Net capital losses of other years. The 1 household income in Canada earns 306710.

How To Create An Income Tax Calculator In Excel Youtube

Find tech jobs in Canada.

Gross income to net income calculator canada. A minimum base salary for Software Developers DevOps QA and other tech professionals in Canada starts at C 85000 per year. After-tax income is your total income net of federal tax provincial tax and payroll tax. Line 23600 Net income.

Gross annual income Taxes Surtax CPP EI Net annual salary. FREE gross to net paycheck calculator and other pay check calculators to help consumers. Using the Debt to Income Ratio Calculator.

Formula for calculating net salary. This is the total amount of net income you make in a month. These calculations are approximate and include the following non-refundable tax credits.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. We use net after-tax instead of gross before tax because you make debt payments with money after taxes. C 29527 22410 20109.

The 50 household income in Canada earns 44807. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. Step 4 Taxable income.

The 5 household income in Canada earns 157486. Line 25000 Other payments deduction. That means that your net pay will be 40568 per year or 3381 per month.

Net income is used to calculate federal and provincial or territorial non-refundable tax credits. Step 3 Net income. The 25 household income in Canada earns 78820.

Net annual salary Weeks of work year Net weekly income. Start by entering your monthly income. C 2461 1868 1676.

The 10 household income in Canada earns 122274. Net annual salary Weeks of work year Net weekly income. One of a suite of free online calculators provided by the team at iCalculator.

Find out how much money you could get if you file a tax return this year. Formula for calculating net salary in BC. Canada Tax Calculators Select a specific online tax calculator from the list below to calculate your annual gross salary and net take home pay after deductions.

Each calculator provides the same analysis of pay but is simplified to allow you to enter your salary based on how you are used to being paid hourly daily etc. Calculate your salary after tax by province compare salary after tax in different provinces with full income tax rates and thresholds for 2021. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Rates are up to date as of June 22 2021. Get started for free. Your average tax rate is 220 and your marginal tax rate is 353.

Salary after Tax is an easy-to-use online calculator for computing your monthly or yearly net salary based on the local fiscal regulations for 2021. Gross annual income Taxes CPP EI Net annual salary Net annual salary Weeks of work year Net weekly income Net weekly income Hours of work week Net hourly wage. Line 25600 Additional deductions.

Online salary calculator for each province in Canada. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary. The CRA also uses your net income and if you are married or living common-law your spouse or common-law partners net income to calculate amounts such as the Canada child benefit the GSTHST credit the social benefits repayment and certain.

Do you have a part-time job or earn money from a side hustle. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. The basic personal tax amount CPPQPP QPIP and EI premiums and the Canada employment amount.

The 75 household income in Canada earns 21811.

Free Dividend Payout Ratio Calculator Investingcalculator

Annual Income Learn How To Calculate Total Annual Income

5 3 Explanation Interpretation Of Article V Under U S Law Canada U S Tax Treaty Rental Income Interpretation Real Estate Rentals

How To Calculate Net Income 12 Steps With Pictures Wikihow

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

How To Calculate Net Income 12 Steps With Pictures Wikihow

Earning Yield Calculator Www Investingcalculator Org Earnings Calculator Html Investing Investment Calculator Financial Calculators Earnings Calculator

Net Salary Calculator Canada Salary Calculator Bad Credit Mortgage Online Mortgage

Return On Equity Calculator Www Investingcalculator Org Return On Equity Html Investing Investment Calcu Return On Equity Financial Calculators Investing

Net Income Template Download Free Excel Template

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

What Is Gross Vs Net Income Definitions And How To Calculate Mbo Partners

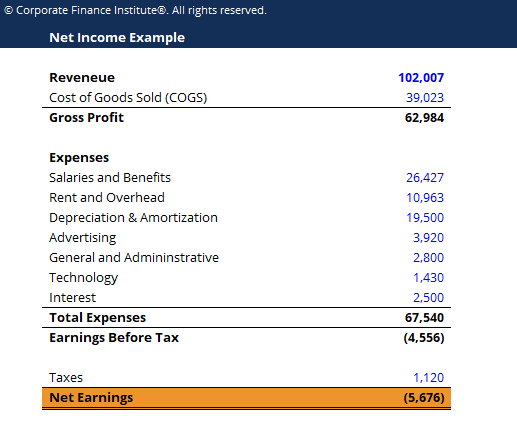

Net Income The Profit Of A Business After Deducting Expenses

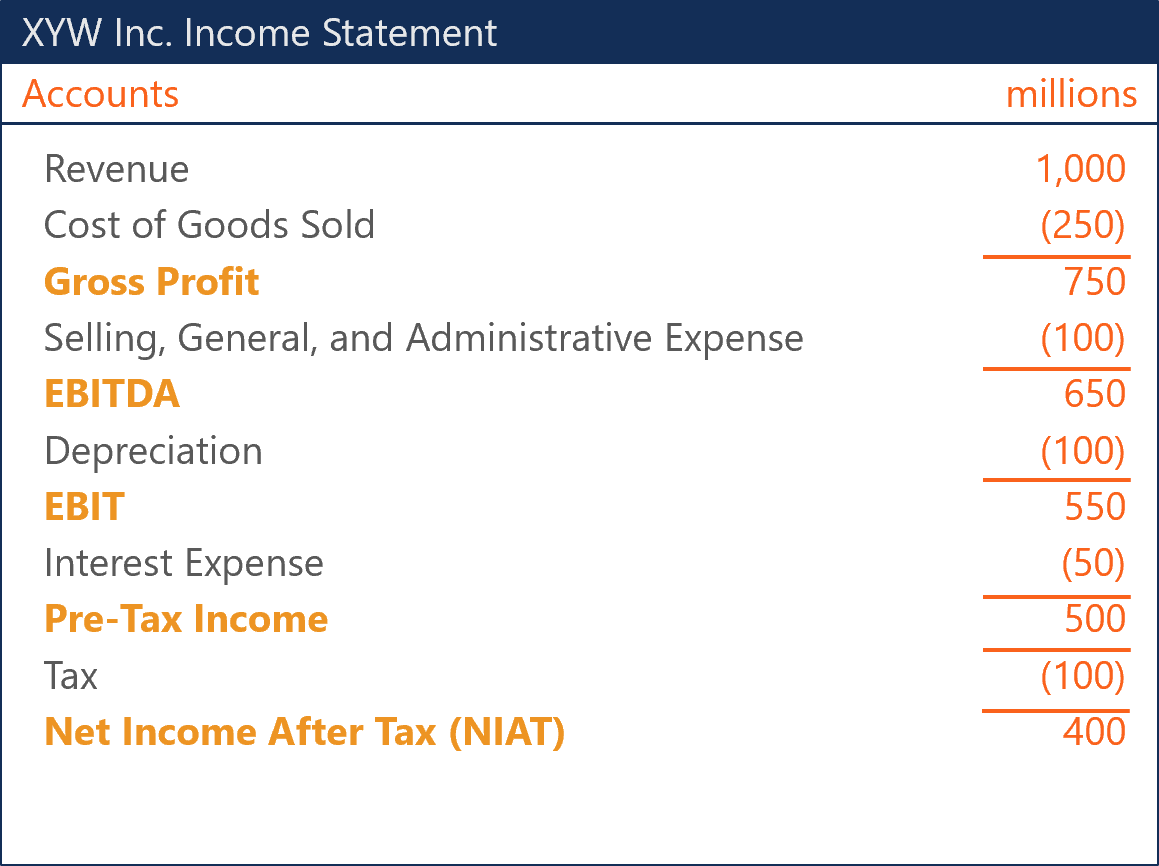

Net Income After Tax Niat Overview How To Calculate Analysis

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

What Is Net Operating Profit After Tax Nopat Formula Definition Quickbooks

Excel Formula Income Tax Bracket Calculation Exceljet

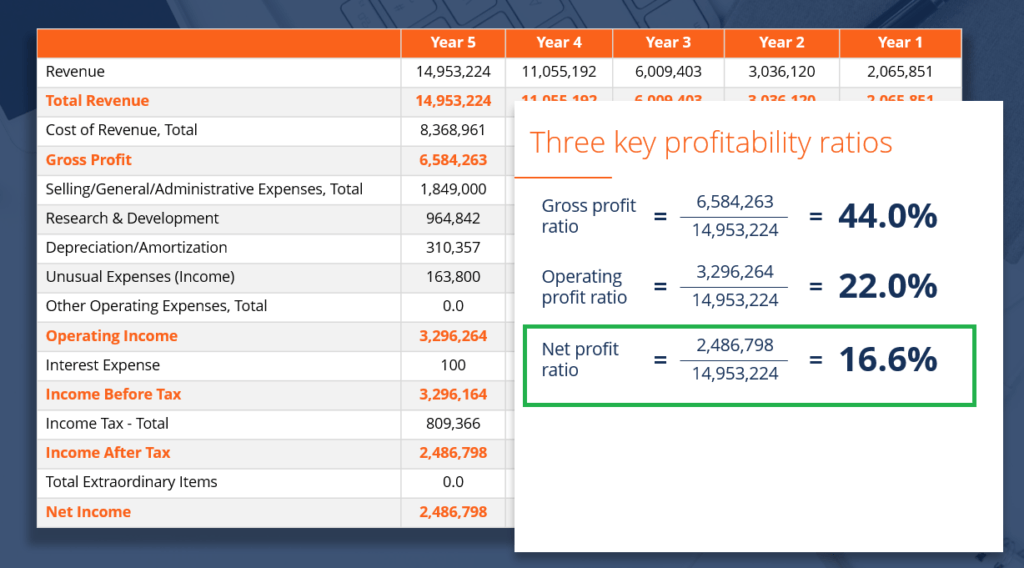

Net Profit Margin Definition Formula And Example Calculation

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Gross Income To Net Income Calculator Canada"