Self Employed Mortgage Broker Salary

Mortgage broker commissions and salary can vary greatly depending on the lender and aggregator. Thats great for reducing your tax bill.

Your Guide To Becoming A Mortgage Broker Smartline

Generating new repeat and referral business can be tough.

Self employed mortgage broker salary. Generating new repeat and referral business can be tough. Mortgage adviser basic starting salaries are usually around 22000 to 25000. Upfront commissions base salaries and ongoing trail.

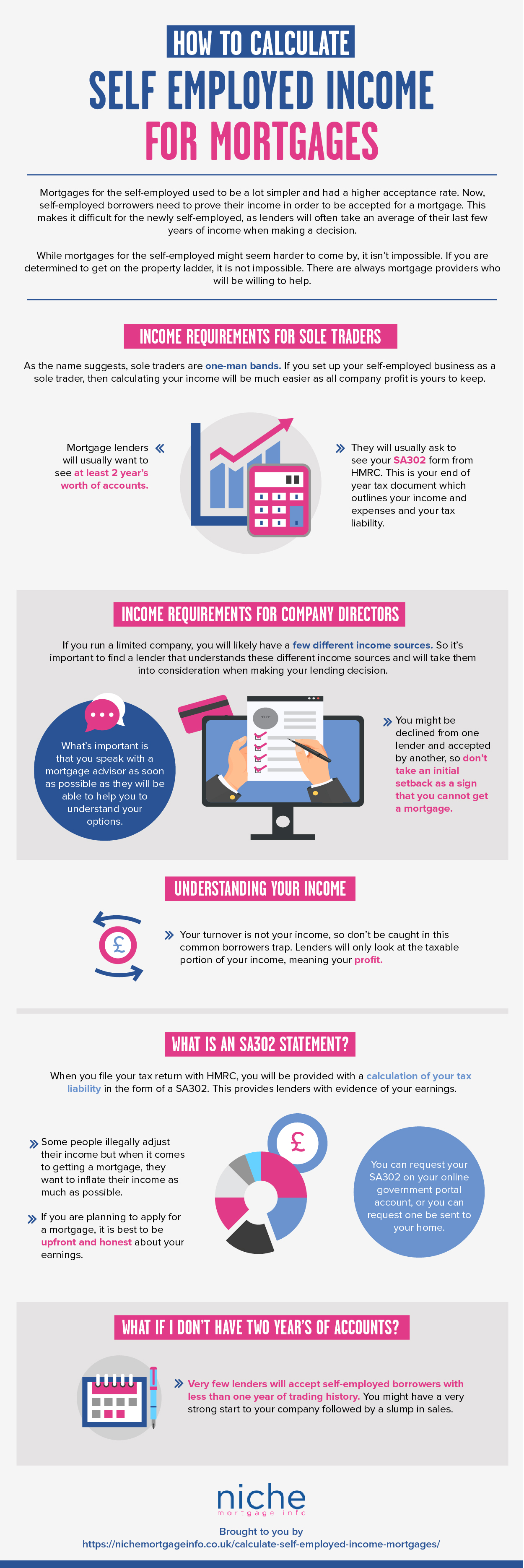

Its also easier to get approved if youre self-employed. As a 100 independent broker we have access to every self-employed friendly lender out there large and small. Self employed mortgages for company directors shouldnt be taxing.

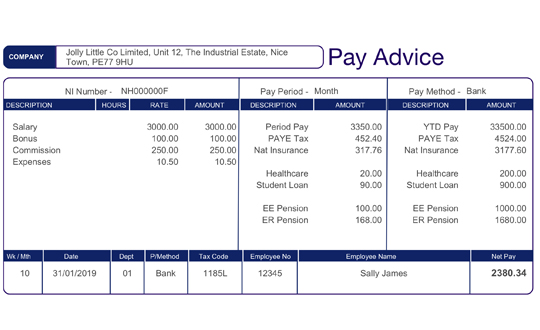

Mortgage broker commissions and salary can vary greatly depending on the lender and aggregator. Upfront commissions base salaries and ongoing trail. Adjustable broker fees from 250 up to 1 of the mortgage amount 28 days ago More.

You could be a sole trader company director or contractor. Please note that the mortgage amount provided by the calculator is for illustrative purposes only. Commission may be paid on top of this.

My thought process is if i can arrange and complete 15 mortgages per month with each one paying out on average 1200 600 broker fee and 600 proc fee for a 150000 mortgage then that is a total of 18000 per month. Tax returns are not required and youll only need one year of self-employment income history and a minimum credit score of 580. With a few years experience you can expect to earn in the region of 45000 to 60000 including commission.

Our specialist advisors will secure the best mortgage rates for your self-employed status period. A directly authorised brokerage with access to all mortgage clubs. This means those who are self-employed now need to apply for a mortgage in the same way as everyone else.

When ready and if wanted assistance with becoming a self-employed home field-based broker. If i was to receive a 50 from this then that would be 9000 per month or 108000 per year. A mortgage brokers pay could show up on your closing costs sheet in a variety of ways.

Mortgage Broker Commissions And Salary. The actual amount you will be able to borrow can vary from lender to lender and will be. The firm are one of the largest partner firm of PRIMIS and have some 53000.

They may charge loan origination fees upfront fees loan administration fees a. We know that most small limited company directors do take a low salary and restrict dividends. The role is self employed with earnings estimated at 80000 - 100000 per annum.

However getting mortgage broker leads has become more achievable with technology. Self-employed people are also being asked to stump up larger deposits. Mortgage Broker Commissions And Salary.

The unintended consequence of reducing your salary is that you undermine your borrowing. The good news according to Gallagher is that self-employed borrowers can usually access the same loans and lenders as home buyers working for an employer - often with a deposit as low as 5 - as long as they meet all. Highly experienced advisers can earn up to 70000 including commission.

Metro Bank for example said any customers who have taken out an SEISS grant will need a deposit of 20 or more. However getting mortgage broker leads has become more achievable with technology. Existing brokers are earning in excess of 100k year.

Its now a legal obligation for lenders to check if you can afford a mortgage repayment if interest rates were to increase by 6-7 and to multiply your income by 4-5 times to assess your maximum borrowing amount. Use our self-employed mortgage calculator to work out how much you might be able to borrow based on the nature of your employment your income and other factors. Showing 1-20 of 57.

Free to set own client fees. As mortgage brokers with a great deal of experience in sourcing mortgages for the self-employed we understand the many forms that self-employment can take from sole traders to personal limited companies company directors or business partners in fact anyone not in the position of a salaried employee and who is paying themselves from the profits of their own business. Whichever model you deploy to pay yourself we can match your income to an appropriate lender.

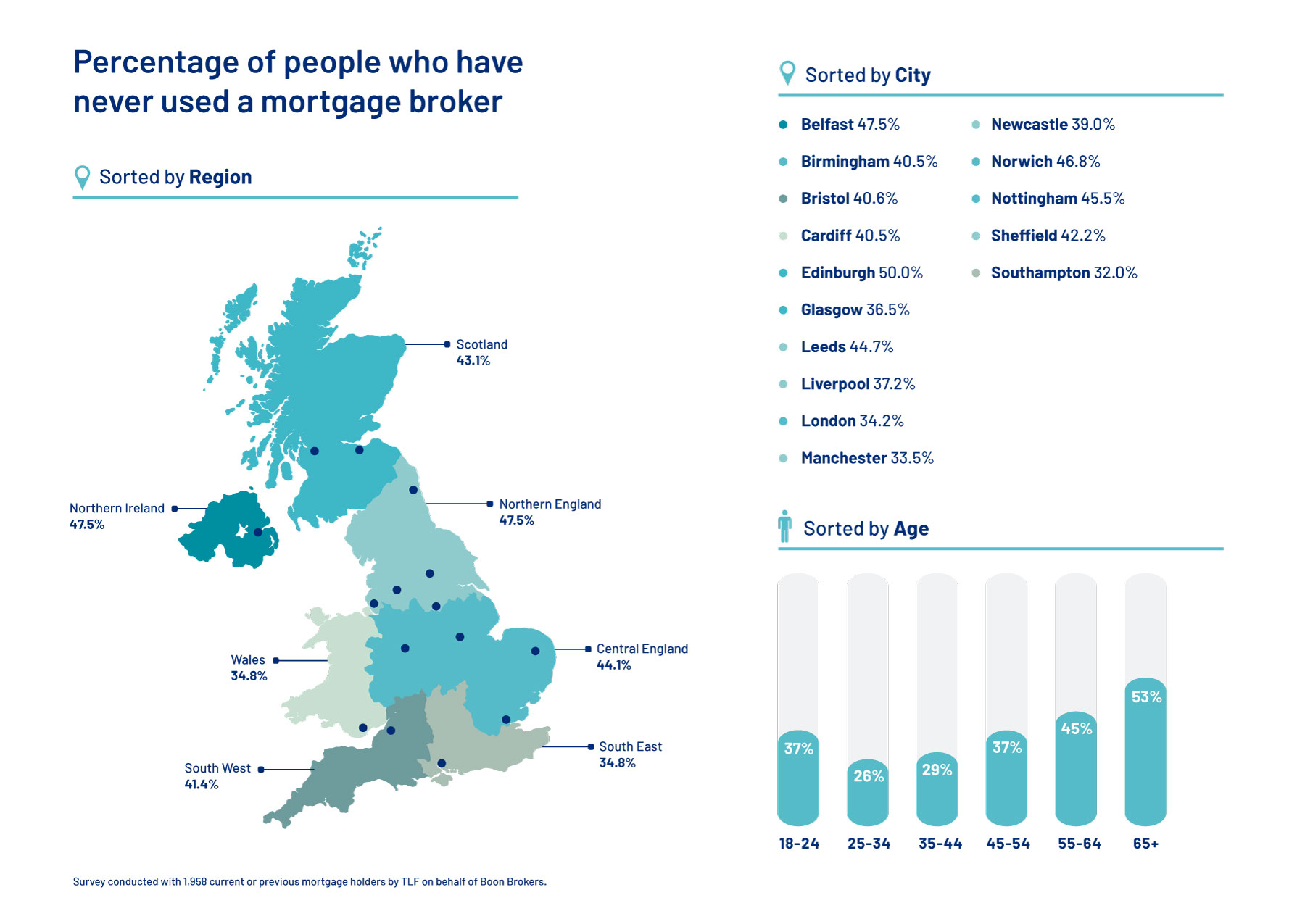

What counts as self-employed. Lenders will view you as self-employed if you own more than 20 to 25 of a business from which you earn your main income. Phil Gallagher mortgage broker with Aussie Belmont in the Lake Macquarie region in NSW says that around one in three of his home-buying customers is self-employed.

Woeful for securing a self employed mortgage.

Mortgage Broker London Free Mortgage Service Yescando

Mortgages For Directors Expert Mortgage Advisor

Self Employed Mortgage Options Qualifications Wowa Ca

Mortgage Broker Costs 2021 How Much Should You Pay In Fees

How To Get A Mortgage When Self Employed Forbes Advisor

Can I Get A Mortgage If I M Self Employed How Much Could I Borrow Crunch

Schedule C Income Mortgagemark Com

Broker Vs Bank Mortgage Brokers Saskatoon Just Some Of The Differences When U Mortgage Broker Mortg Mortgage Brokers Mortgage Marketing Refinance Mortgage

How To Get A Mortgage With 1 Years Accounts Expert Mortgage Advisor

Can I Get A Mortgage If I M Self Employed How Much Could I Borrow Crunch

Do Mortgage Lenders Use Gross Or Net Income For Self Employed Steven Crews My Mortgage Broker Calgary

How To Get A Mortgage If You Are Self Employed Freeandclear Mortgage Payoff Pay Off Mortgage Early The Borrowers

Mortgage Lenders Income Requirements For The Self Employed Niche

/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

How To Get Pre Approved For A Mortgage

Self Employed Mortgages With 1 Year S Accounts Jmb

How To Get A Mortgage With A New Job Boon Brokers

Self Employed Mortgage Advice Mortgages Cls Money

Self Employed Mortgage Options Get Your Loan Approved

Post a Comment for "Self Employed Mortgage Broker Salary"